Consultancy firm Verified Market Research recently published a report which valued the warehouse robotics market at US$3.97bn (£2.9bn) in 2020, and projects it to reach US$9.1bn (£6.8bn) by 2028, growing at a CAGR of 14.0%.

Warehouse Robotics Market report stated that robots are no longer nice-to-have accessories for efficient warehouse operations, thanks to the ability to increase productivity, accuracy, and operational efficiency.

It added that all warehouse automation adds value to warehousing operations by automating menial, repetitive tasks, allowing human workers to focus on more complex tasks. Robots are increasingly becoming a fundamental aspect of warehouses, the report said.

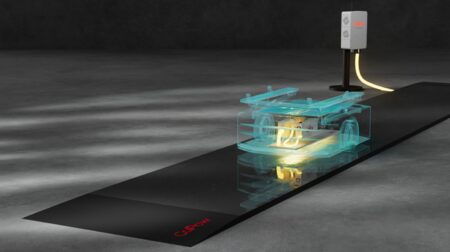

It also listed some types of robots used in warehouses, including Autonomous Mobile Robots (AMR), aerial drones, Automated Guided Vehicles (AGVs), and Automated Storage and Retrieval systems (AS and RS).

The expansion of the retail industry from brick-and-mortar stores to online service providers has made warehouse management more challenging as the number of deliveries has increased exponentially, it added.

Currently, the logistic industry – as a result of the e-commerce revolution – faces a shortage of labour, while there is a need for more rapid parcel shipments, with a huge variety of different packing is also on a rise. The use of robots in logistics is still at a nascent stage, however the report said it is a real option to combat the challenge of labour availability in the industry.

Furthermore, the International Federation of Robotics, World Robotics 2018 Service Robots report, disclosed that in 2017 logistics robots experienced robust growth with 69,000 units installed, a 162% increase over 2016. While this latest report projects it to reach US$7.5bn (£5.6bn) by 2023.

The study also highlighted ABB’s partnership with Covariant as a key development, with other key players listed as Honeywell, Kuka, Omron, Yaskawa Electric, Fetch Robotics, Daifuku, Dematic and Knapp.