Perception radar solutions provider Arbe Robotics has closed its previously announced public offering of an aggregate of 8,250,000 ordinary shares.

The company said that it expects to bring in around US$15 million in gross proceeds from the IPO, and this is before deducting the underwriter’s discounts, commissions, and other offering expenses.

READ MORE: NVIDIA advances robot learning and humanoid development using AI

The potential additional gross proceeds to the company from the Tranche A Warrants and Tranche B Warrants, if fully exercised on a cash basis, will be approximately US$34.4 million.

It said that no assurance can be given that any of the Tranche A Warrants or Tranche B Warrants will be exercised. Arbe Robotics has said that it intends to use the net proceeds from this offering for working capital and general corporate purposes.

The deal was led by institutional investors including AWM Investment Company, the investment adviser of the Special Situations Funds, which also participated in Arbe Robotics’ previous US$23 million financing round.

Canaccord Genuity acted as the sole bookrunner for the offering. And Roth Capital Partners acted as the co-manager for the offering.

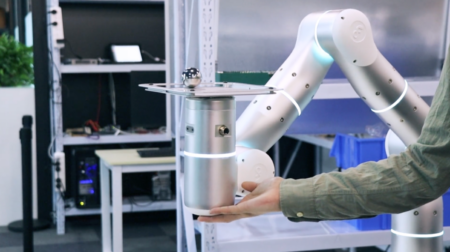

Arbe Robotics has said that it is starting with sensors for advanced driver-assist systems (ADAS), paving the way to fully autonomous vehicles.

The company claimed that its radar technology is 100 times more detailed than other radars on the market and that it is a critical sensor for SAE Level 2 and higher autonomy.

Join more than 11,000 industry leaders at Robotics and Automation Exhibition on 25-26 March 2025. Explore cutting-edge technologies, connect with peers and discover the latest innovations shaping the future of manufacturing, engineering and logistics. Register now to secure your place at this premier event!